Anatomy of a billion dollar patent drug dispute - the Merck Keytruda patent settlement

Author note - This blog was first published in February 2018, and has since become one of our most popular blogs. We updated this in October 2019 with fresh content, in particular a full Licensing Potential Analysis.

Keytruda, the Merck brand name for pembrolizumab, is a humanized antibody used in cancer treatment. According to Reuters, Keytruda bought in more than $1 billion in sales in the third quarter of 2017 and is expected to generate peak annual sales of USD8.2 billion in 2020. No wonder then, that a recent positive trial report was enough to increase the value of Merck shares by 6%.

Pembrolizumab was first invented by three scientists at the Dutch pharma company Organon, which was purchased by Schering-Plough, in turn acquired by Merck, who according to Wikipedia were at one stage preparing to out-license the drug, before its potential was recognised. Since then its use has moved from melanoma to other cancers, even if at a cost to patients of up to $150,000 per year.

Not surprisingly, there has been patent litigation in this area. Back in January 2017, Merck announced a settlement with Bristol-Myers Squibb and Ono Pharamceutical, which included an upfront payment by Merck of USD625 million, and royalties of 6.5% or 2.5% of sales.

This patent dispute has been reviewed by Mathieu Collin of INSERM. Mr Collin identified that the main Pembrolizumab patent family included US8354509 Antibodies to human programmed death receptor PD-1 (priority date of June 2007), while the most similar patent family filed by Bristol Myers Squib included US8779105 Monoclonal antibodies to programmed death 1 (PD-1) (priority date of May 2005, and so earlier than the Merck patent family).

Ambercite has developed both graphical and list-based tools to analyse patent families and their relationships with other patent families - so what Ambercite show about the relationship between these two patent families?

There are two main tools - Amberscope which provides a graphical overview, and Ambercite which provides a list based perspective. Ambercite is often more useful in most circumstances, but Amberscope does provide a unique perspective.

Amberscope analysis

For the Amberscope analysis, we might start with the Bristol Myers Squibb patent, as this was the earlier patent.

The Amberscope image below shows the direct patent network family for US8779105 (the patent number shown in the details box is US8008449 - the first granted US family member for this patent family).

There are a few points to note in this image. First of all, this network is very packed - our data suggests that 368 separate patent families cite this Bristol Myers patent families, while there were 29 separate prior art families. These statistics suggest that this area is commercially important. Not surprisingly, this has led to a very high value of the Ambercite patent value predictor Amberscore - this value is 28, compared to the average value of 1 for Amberscore against all patent families in our database.

While descriptive, this network is almost too packed to work with. Luckily, Amberscope comes with some tools that can simplify networks. In the image below the priority date filter has been set that that only patents with a priority date of 2005 and later are shown, while the Similarity filter has been set so that only the 10% most similar patents are shown (see the small orange segment, with a value of 10).

In this image below, the similarity filter has been further focused so that only the most similar 1% of patents are shown.

Of note, one of the three remaining patents after this analysis is US8354509, the (now owned by Merck) pembrolizumab patent. This has an Amberscore value of 6.5 - still much higher than average, but not as high as the Bristol Myers Squibb patent. We have also recoloured this patent in blue. Note the arrow pointing to the Merck (MSD) patent - Amberscope is configured so that the arrows always point towards the later patent.

What this picture basically says is that one of the most similar and later patents to the now BSK patent is that which claims pembrolizumab.

If we look carefully at the details box for US8354509, there is a button that says '30 more'. This means that if we press this button, Amberscope will refocus the network onto this patent US8354509, and there will be 30 additional patents not found in the network for the Bristol Myers Squibb patent.

If we do press this button, the new patent network looks like this - also a very packed network, again suggesting high patent value. In this network, the US8008449 patent remains coloured green, so you can see where it fits into the broader network.

Ambercite Ai analysis of the pembrolizumab patent

The Ambercite Ai patent search engine allows you to do a similar analysis in table form. If we enter the Bristol Myers Squibb patent number, and ask for the 5 most similar patents, the resulting list looks like this (click on the image to see a fully interactive version of this result).

If we wished, we could choose to display the most similar 10, 50....up to the most similar 2000 patents if we wished, and then apply a series of filters on the results.

But in this case, the 5 most similar patents is enough, because in 4th position is the Merck patent pembrolizumab patent US83545092.

The value of Ambercite Similarity scores

If we look at the third column in the table above, this shows a list of "Similarity Scores". This shows Similarity scores trending downwards from 552 for the Bristol Myers Squibb patent family - and the higher the value, the more Ambercite predicts that two patents are similar. In the case of US8354509, it is still 396, which is still an exceptionally high score for similarity.

Similarity scores are a key benefit of Ambercite. While other patent search engines can provide a list of forward or backward citations, these are not ranked, and often not grouped by patent family. In the case of US87791058, a conventional list of citations would provide a list of 685 forward citations. Ok, there is plenty of information to work with - but where do you start?

In contrast, with the Ambercite analysis, it becomes soon is clear that the pembrolizumab patent is very similar - and this insight soon leads you to the very lucrative payday that Bristol Myers Squibb had last year.

Licensing Potential analysis

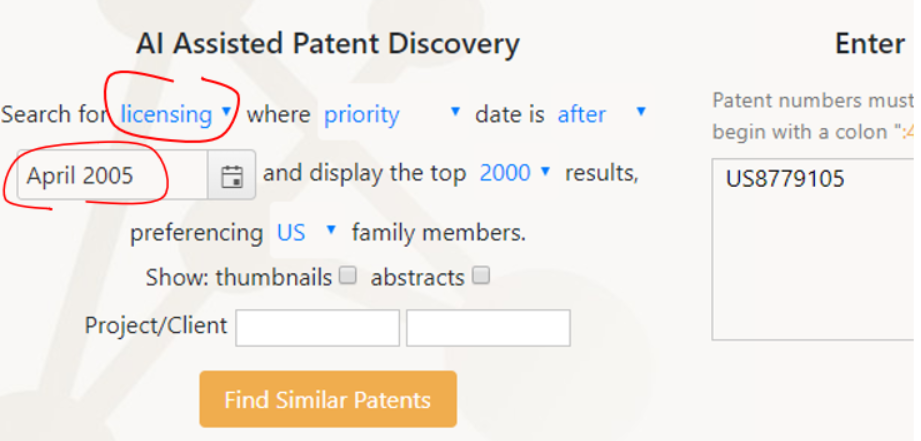

Ambercite AI can also be used to run a ‘Licensing Potential’ analysis on any patent or group of patents. As always with Ambercite, running this search is simple, as shown below. Again we have entered the Bristol Myers Squibb patent number US8779105, but this time we have asked for a ‘licensing search’ , based on the priority date for this patent of June 2005. This will return all predicted-to-be-similar patents with a priority date of after April 2005.

The first few results (of more than 1300) are shown below. Note the new output 'Licensing Potential’ - this is a predictor of subject matter overlap between patents.

The above image is hyperlinked to an interactive version the full list of results, if you are interested in seeing the full list.

Also shown above is an ‘Export’ button. Using this, you can export all of the results to an Excel spreadsheet. Many companies have more than one patent in the list, and in Excel, it is straightforward to add the different Licensing Potential values together for a given company. But often, as in this case, there is a further step of confirming the ultimate owner of the leading companies in the list (as assessed by Licensing Potential) - but this information can often be deduced from a Google search.

Having done all of that, we can now present a list of the leading companies, in terms of their ‘Total Licensing Potential’:

Does this mean that that Novartis etc may need to license to the Bristol Myers Squib patent?

That is for others to say, based on an analysis of the products they are selling. But as part of the process of determining this, a patent analyst could look at the top ranking patents (in terms of Ambercite similarity score) filed by these companies, and then check to see if the patents relate to commercial products.

Regardless, the benefit of this list is that patent owners can know where to start looking for licensing candidates, and the most similar patents being filed by these companies. Admittedly in this case Bristol Myers Squibb probably already know where exactly where to start, but this does not apply to patent owners we have spoken to.

Want to try Ambercite on your own patents?

Readers are free to sign up to Ambercite at any time and run a free trial - no credit card required, but some restriction apply. Just hit the link below, and follow the simple instructions