Do you need to save money renewing patents?

April 3 2020: - Very difficult times are ahead of us due to COVID-19, and a lot of companies are looking to save costs wherever they can.

Intellectual property costs will no doubt be under great pressure, and this will likely include much greater scrutiny on patent renewal costs. Many patents need to be renewed annually after the first few years, and costs to do so in some jurisdictions can exceed USD 2,000. US patents, while only need to be renewed three times over their lifetime, can cost in excess of USD 7,000 for the 12th year renewal.

Faced with such costs, many companies may question the return on investment of every renewal. Yet there is a risk when doing so, that valuable patents may be abandoned along with less valuable patents.

Patents are filed by companies for many reasons. If the objective of the patent is to protect a current product, the value proposition of renewing the patent may be easy to understand.

But if the patent is filed to help provide a defensive ‘patent thicket’ against competitors, or to underpin a potential IP licensing arrangement, this indirect value proposition may be harder to assess. In better times, the above reasons would be enough to justify the renewal of the patents.

But in the current times, a stronger justification for renewal may be required, and a justification based on data.

How Ambercite can help

Ambercite employs a unique algorithm to determine the most similar patents to one or more nominated patents. Its ability to identify the most similar patents has been benchmarked to perform better than other search engines, thanks to its algorithms that go beyond similar language.

The value of this capability is that Ambercite data can be used to help provide useful data to help make these renewal decisions, and in a fast and efficient way.

There are in fact two ways of using Ambercite to make renewal decisions.

A comparative review of a group or portfolio of patents

Reviewing the owners of the most similar patents to individual patents.

We will demonstrate both methods with a case study based on Nike shoe patents.

1) Using Ambercite to review a portfolio or group of patents

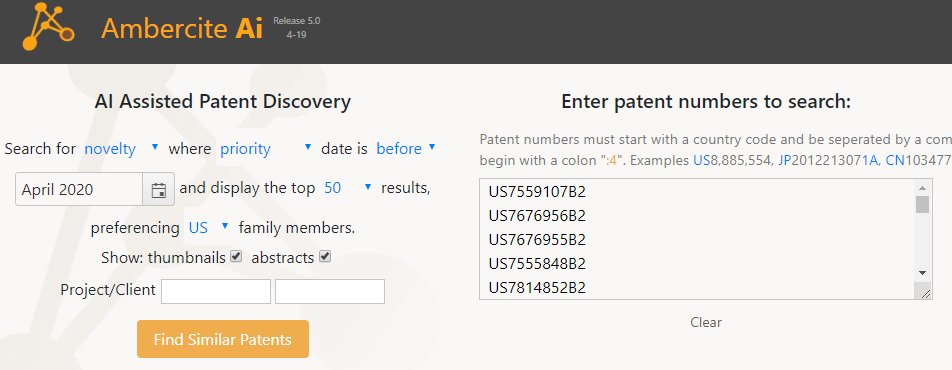

As an example of what is possible, we looked for granted US patents for shoes filed by Nike in 2008, i.e probably needing renewal in 2020. A more conventional patent database found 23 patents that meet that criteria. A partial list of these is shown below, entered in an Ambercite query box as the first part of a patent search.

Ambercite Search Input Screen - Partial View

After a search is run - the patents searched are shown in the below query - we have sorted the list based on ‘Amberscore’. Amberscore is found in the last column in the table (NOTE that if you click on this image, you can open up an interactive Ambercite version of this search).

The rest of the list descends in Amberscore value as you would expect, but a ‘trap for young players’ is that the patents at the bottom of the list are listed as ‘Duplicate’ patents.

Ambercite Patents duplicated

By ‘duplicate’, Ambercite is indicating that they share a ‘simple’ patent family with an earlier listed patent on the list.

But we look at the first listed of these patents (US7676956), this is in the same patent family as the earlier listed patent family US7555848. US7555848 is in the list of patents with Amberscore values - so in this case, we would suggest you would analyse US7676956 in Ambercite in the same way that you would analyse US7555848.

Reviewing Amberscore results

‘Amberscore’ is a metric we have developed that suggests the ‘popularity’ of a patent - based on such factors as the forward citation count, backward citation count, family members, how recent the forward citations are, and how interconnected the citations are. To make it is easier to understand, we have ‘normalised’ it so that the average value is 1. Any value above 1 is above average (and there is no upper scale for Amberscore).

More to the point, while an imperfect predictor, patents with higher Amberscore values tend to be more commercially important. As an example, the famous Steve Jobs patent that essentially disclosed the first iPhone, US7479949, Touch screen device, method, and graphical user interface for determining commands by applying heuristics, has an Amberscore value of 85 - which would be enough to place it in the top 1%* of Amberscore values.

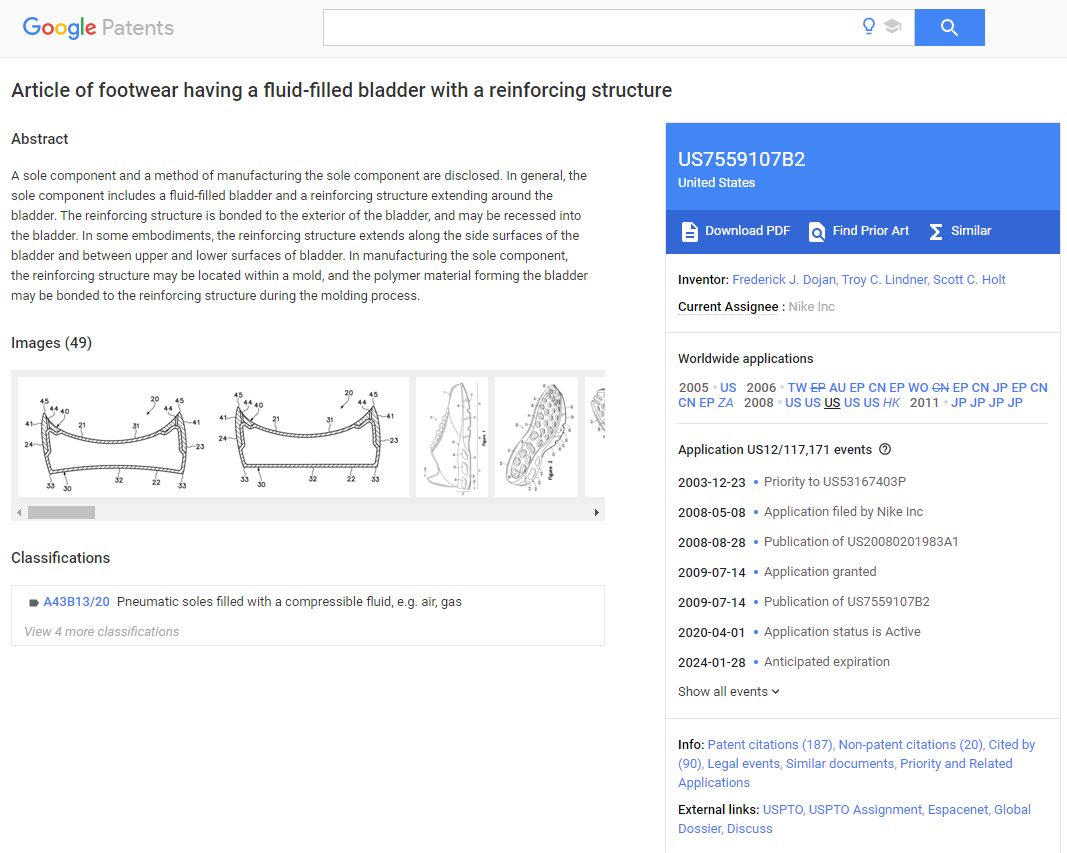

In this case, the patent US7559107 was at the top of the list, with an Amberscore value of 11.95, which places it in about the top 2% of Amberscore values.

This Google Patent summary shows that this patent has 187 forward citations, 20 backward citations, while Espacenet shows that it has 48 family members.

In contrast, the lowest-rated patent in our list was US7614169, with an Amberscore value of 0.26 (worse than about 80% granted US patents). It has only been cited by 2 other patents, and there are only 2 family members.

Implications from a portfolio review

In this case, this data would suggest that Nike prioritize the renewal of US7559107, while if it was looking for cost savings, it might not renew US7614169.

Of course, there may be other factors that affect your renewal decisions such as whether these patents are protecting current products of Nike - but the above process adds a valuable layer of data to your decision-making process.

There is also the option to look at individual patents, as will be shown below.

2) Using Ambercite to review individual patents

The first method is a good preliminary method for a group or portfolio of patents, but if you have slightly more time, you can investigate individual patents in more detail.

As an example of this, let us take a look at the now unloved Nike patent US7614169, with a representative image shown below:

Maybe a closer look at this patent will help provide information to support the renewal or abandonment decision?

Ambercite includes the ability to run a “Licensing Search”. This is best run with the type of search set to “Licensing”, and the date setting set to show patents filed after the priority date of this patent, as shown below. We have requested a list of the 100 most similar patents.

Ambercite Patent Search Input Screen -Partial view

The top three results from this search are shown below - or you can click on this image to see an interactive version of all of these results

Note that in this top three list, two of the patents are also owned by Nike. In fact, for this list of the top 100 patents, 46 are owned by Nike, including 5 of the top 10 patents

But who owns the rest of these patents?

The most common owners are shown in the chart below. Under Armour lead this list, with 5 similar patents.

The highest ranked of these patents (lowest similarity rank) is US9320316, for a 3D zonal compression show, which covers a sole design:

So would it be worth renewing the Nike patent US7614169? If I was a patent manager for Nike, I might consider the following questions that arise from this analysis;

How competitive are Under Armour (and the other top listed applicants) to Nike?

How similar are the top-ranking (most similar) patents of these top-ranking owners?

Presumably, Nike’s patent managers would have a good understanding of who their competitors are, and be skilled at comparing patents, so in practice, this type of analysis should be straightforward and efficient.

Can I also do this in a semantic search engine?

In theory you could, but long experience and independent testing has shown that semantic searching is not as reliable at finding similar patents, when compared to Ambercite. In practice, this means that you will make important commercial decisions with lower quality data - i.e. potentially lower-quality decisions.

How can I start using Ambercite?

You can try Ambercite yourself in our no-cost trial version, found here:

However, to run these sorts of analyses discussed in our blog, you will need to contact us about a corporate subscription. If you do contact us, we would be very happy to provide an online demonstration of the above approach, using patents from your own patent portfolio.

Return on investment

A new subscription may cost you a fraction of the cost of renewing your patent portfolio (or of inadvertently abandoning a valuable patent), so the return on investment should be very high.

Ambercite is also very easy to use, so training costs will be very low (and Ambercite will include online training as part of the subscription cost).

Notes:

*Ambercite does not provide Amberscore benchmarking, but for the purposes of this blog, we ran 1000 randomly chosen granted patents between US7,000,000 and UA10,000,000 through Ambercite, and analysed the distribution of Amberscore values from this sample. This is open for all to do, or you may choose to run a population sample of patents that represent comparable patents from your industry.